Understanding and managing the financial aspects of an ABA (Applied Behavior Analysis) business is crucial for its success. A well-structured financial projection helps you anticipate future revenues, manage expenses, and ensure the sustainability of your practice. This article will guide you through creating and using an ABA business financial projection template in Excel, which is vital for effective financial planning.

ABA business financial projections are essential tools for any ABA practice. These projections allow you to forecast revenue, track expenses, and understand the overall financial health of your business. By using an ABA business financial projection template, you can simplify and streamline your financial planning process.

Importance of an ABA Business Financial Projection Template

An ABA business financial projection template serves as a comprehensive roadmap for your financial planning. It helps you estimate revenues, expenses, and profitability with greater accuracy.

Benefits of Using a Template

Using an ABA business financial projection template has several advantages. It simplifies complex financial calculations and ensures consistency across your forecasts.

- Time-saving: A template reduces the time spent on manual calculations, allowing you to focus on strategic planning.

- Consistency: Templates ensure that your financial forecasts are uniform and standardized, minimizing errors.

- Accuracy: With predefined formulas and structures, templates improve the accuracy of your financial projections.

Components of a Financial Projection Template

An ABA business financial projection template typically includes sections for revenue, expenses, cash flow, and profit and loss statements.

- Revenue Projections: Estimating future income from services provided.

- Expense Projections: Calculating expected operational costs.

- Profit and Loss Statement: Summarizing revenues and expenses to determine net profit.

- Cash Flow Projections: Monitoring cash inflows and outflows to ensure liquidity.

- Break-even Analysis: Identifying the point where revenues equal expenses, ensuring business sustainability.

Creating ABA Business Financial Projections in Excel

Excel is widely used for financial projections due to its versatility and ease of use. You can create customized ABA business financial projection templates tailored to your specific needs.

Setting Up Your Excel Template

Start by setting up an Excel spreadsheet with relevant sections. Include columns for each month and rows for different financial categories.

- Revenue Streams: List all sources of income, such as therapy sessions, consultations, and training programs.

- Expenses: Include all costs, such as salaries, rent, utilities, and supplies.

- Net Profit Calculation: Subtract total expenses from total revenue to determine net profit.

- Cash Flow Monitoring: Track monthly cash inflows and outflows to manage liquidity effectively.

Customizing the Template

Customize your Excel template to reflect your ABA business model. Include specific categories relevant to your practice, such as therapy types, client demographics, and billing cycles.

- Therapy Sessions: Estimate the number of sessions per month and calculate the corresponding revenue.

- Operational Costs: Break down expenses into fixed and variable costs for more precise projections.

- Growth Projections: Factor in potential growth by adjusting revenue and expense estimates for future periods.

ABA Revenue Projections

Revenue projections are a critical component of your financial planning. They help you estimate the income generated from various services offered by your ABA practice.

Estimating Revenue Streams

To create accurate revenue projections, identify all potential sources of income. This may include therapy sessions, assessments, consultations, and training programs.

- Therapy Sessions: Estimate the number of sessions conducted per week or month and multiply by the session fee.

- Consultations and Assessments: Include income from initial assessments and follow-up consultations.

- Training Programs: Factor in revenue from any workshops or training sessions you offer to parents or professionals.

Using Historical Data

If your ABA business is already operational, use historical data to inform your projections. Analyze past revenue trends and adjust your projections based on seasonal variations and growth expectations.

- Historical Revenue Trends: Look at your past revenue data to identify trends and patterns.

- Adjusting for Seasonality: Some services may have higher demand during certain times of the year, so adjust projections accordingly.

- Growth Adjustments: Factor in anticipated business growth when projecting future revenues.

ABA Expense Projections

Accurate expense projections are crucial for managing the financial health of your ABA practice. By forecasting expenses, you can better control costs and ensure profitability.

Categorizing Expenses

Start by categorizing your expenses into fixed and variable costs. Fixed costs remain constant, while variable costs fluctuate based on business activity.

- Fixed Costs: Include rent, salaries, insurance, and utilities.

- Variable Costs: Include materials, supplies, travel expenses, and marketing costs.

- Unexpected Expenses: Set aside a contingency fund for unforeseen expenses, such as equipment repairs or legal fees.

Managing Operational Costs

Effective management of operational costs is vital for maintaining profitability. Regularly review and adjust your expense projections to reflect changes in your business environment.

- Cost-Cutting Strategies: Identify areas where you can reduce costs without compromising service quality.

- Supplier Negotiations: Negotiate with suppliers to get better deals on materials and supplies.

- Efficiency Improvements: Implement process improvements to reduce waste and increase productivity.

ABA Profit and Loss Statement

A profit and loss statement provides a snapshot of your business’s financial performance over a specific period. It summarizes revenues, expenses, and net profit.

Creating a Profit and Loss Statement

To create a profit and loss statement in Excel, list all revenue streams and subtract total expenses from total revenue to calculate net profit.

- Revenue Section: Include all sources of income, such as therapy fees, consultations, and training programs.

- Expense Section: List all costs, including salaries, rent, utilities, and materials.

- Net Profit Calculation: Subtract total expenses from total revenue to determine your net profit for the period.

Analyzing Financial Performance

Regularly analyzing your profit and loss statement helps you assess the financial health of your ABA practice. Look for trends and identify areas where you can improve profitability.

- Revenue Growth: Track changes in revenue over time to assess business growth.

- Expense Management: Monitor expenses to ensure they are within budget and identify areas for cost reduction.

- Profitability Trends: Analyze net profit trends to determine if your business is becoming more or less profitable.

ABA Cash Flow Projections

Cash flow projections are essential for managing the day-to-day financial operations of your ABA practice. They help you ensure that you have enough cash to cover expenses.

Monitoring Cash Inflows and Outflows

To create cash flow projections, track all cash inflows and outflows on a monthly basis. This includes revenue from services and payments for expenses.

- Cash Inflows: Include payments received from clients, insurance reimbursements, and any other income sources.

- Cash Outflows: List all payments made for expenses, including salaries, rent, supplies, and utilities.

- Net Cash Flow: Subtract total cash outflows from total cash inflows to determine your net cash flow for each month.

Ensuring Liquidity

Maintaining positive cash flow is critical for the sustainability of your ABA practice. Ensure that you have sufficient liquidity to cover expenses, especially during periods of low revenue.

- Cash Reserve: Maintain a cash reserve to cover unexpected expenses or revenue shortfalls.

- Credit Lines: Consider establishing a credit line for emergencies, ensuring access to funds when needed.

- Regular Monitoring: Review cash flow projections regularly to identify potential cash shortfalls and take corrective action.

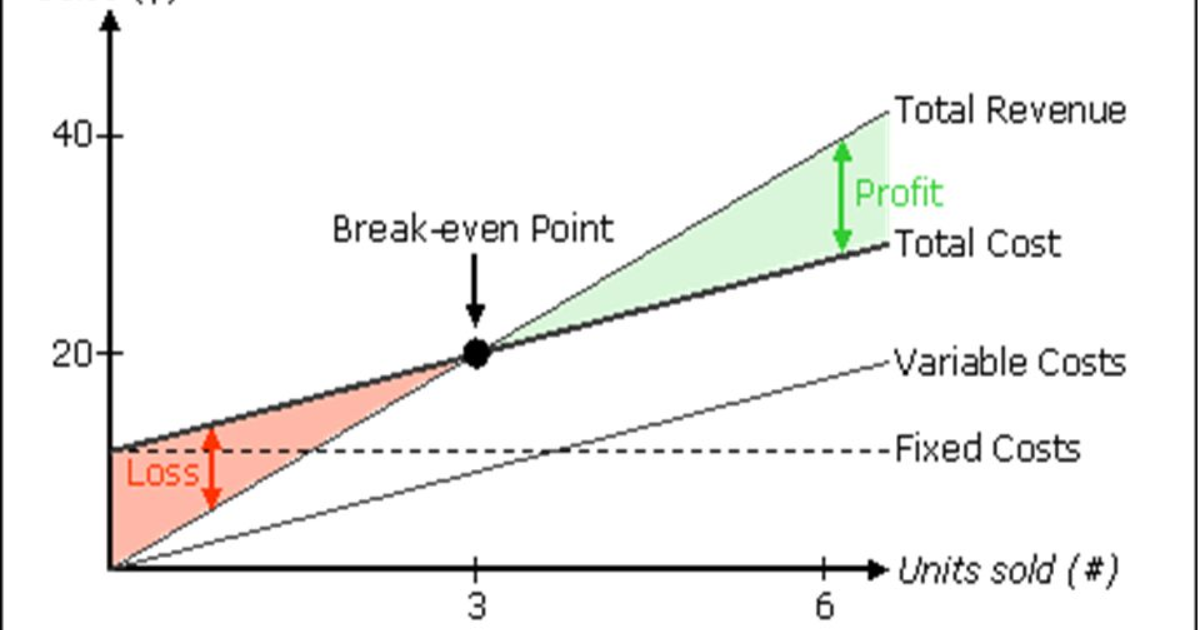

ABA Break-Even Analysis

A break-even analysis helps you determine the point at which your ABA practice becomes profitable. It calculates the level of revenue needed to cover all expenses.

Conducting a Break-Even Analysis

To conduct a break-even analysis, calculate your total fixed and variable costs and determine the revenue needed to cover these costs.

- Fixed Costs: Include rent, salaries, insurance, and utilities.

- Variable Costs: Include materials, supplies, and other costs that fluctuate with business activity.

- Break-Even Point: Divide total fixed costs by the difference between revenue per unit (e.g., therapy session) and variable cost per unit.

Using Break-Even Analysis for Planning

A break-even analysis is a valuable tool for financial planning. It helps you set revenue targets and make informed decisions about pricing and cost management.

- Revenue Targets: Use break-even analysis to set realistic revenue targets for your ABA practice.

- Pricing Strategy: Adjust your pricing to ensure that it covers costs and contributes to profitability.

- Expense Control: Monitor and control expenses to stay below the break-even point, ensuring that your practice remains profitable.

ABA Balance Sheet Projections

A balance sheet provides a snapshot of your ABA practice’s financial position at a specific point in time. It includes assets, liabilities, and equity.

Creating Balance Sheet Projections

To create balance sheet projections, list all assets, liabilities, and equity for your ABA practice.

- Assets: Include cash, accounts receivable, equipment, and property.

- Liabilities: List all debts, including loans, accounts payable, and accrued expenses.

- Equity: Calculate equity by subtracting total liabilities from total assets.

Analyzing Financial Position

Regularly analyzing your balance sheet helps you assess the financial stability of your ABA practice. Look for trends and identify areas where you can improve your financial position.

- Asset Growth: Track changes in assets to assess business growth and financial strength.

- Debt Management: Monitor liabilities to ensure that your ABA practice is not over-leveraged.

- Equity Trends: Analyze equity trends to determine if your practice is building value over time.

FAQs

What is an ABA business financial projection template?

An ABA business financial projection template is a tool used to estimate future revenues, expenses, and profitability.

How can I create financial projections for my ABA practice?

Use Excel to create customized financial projection templates tailored to your ABA business model.

Why is a profit and loss statement important for ABA businesses?

A profit and loss statement provides a summary of revenues and expenses, helping you assess financial performance.

What is the purpose of a break-even analysis?

A break-even analysis helps you determine the revenue needed to cover all expenses, ensuring business profitability.

How often should I review my financial projections?

Review your financial projections regularly to ensure they reflect current business conditions and adjust as needed.

Conclusion

Effective financial planning is essential for the success of your ABA practice. By using an ABA business financial projection template in Excel, you can create detailed and accurate forecasts that guide decision-making. Regularly monitoring revenue, expenses, cash flow, and profitability will help you maintain the financial health of your practice. A well-structured financial plan not only ensures sustainability but also positions your ABA business for long-term growth and success.